The Daily Money: It's still about eggs

Good morning! It’s Daniel de Visé with your Daily Money, lingering inflation edition.

Inflation picked up for a fourth straight month in January, amid another rise in in food and energy costs, Paul Davidson reports, possibly setting the stage for a year of halting progress in the battle to slow consumer price increases as President Donald Trump rolls out his import tariffs.

You're probably wondering what that means for interest rates.

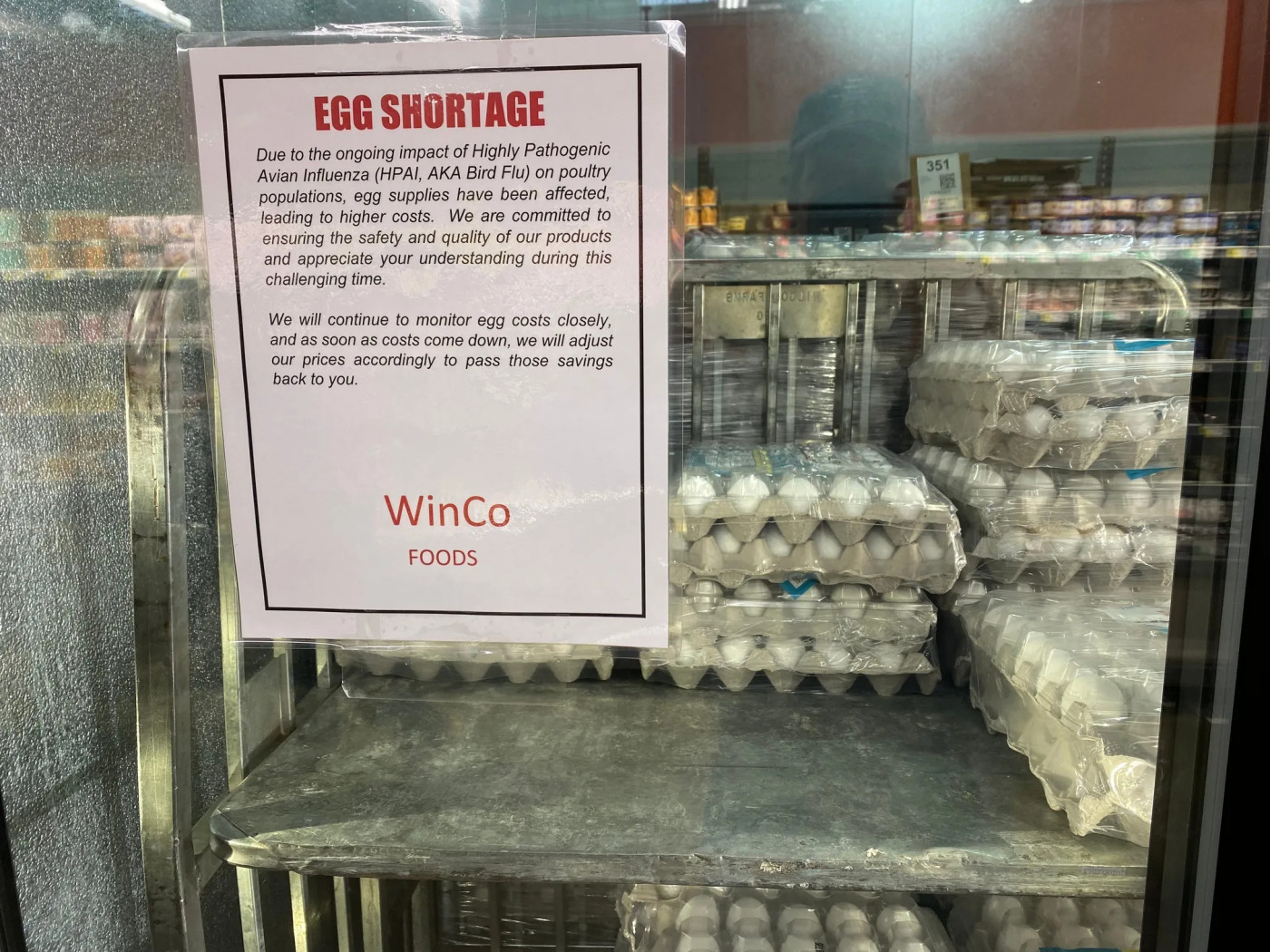

And what about egg prices?

Starting off your day with bacon and eggs? It'll cost you.

Grocery price inflation has come a long way since hitting 13.5% in the summer of 2022, but January saw a notable jump, with prices up 1.9% from the same month last year, Bailey Schulz reports.

The item with the largest monthly price jump in consumers' grocery carts? We'll give you a dozen guesses.

📰 More stories you shouldn't miss 📰

- Will tariffs hurt the auto industry?

- Gutting USAID harms American farmers

- Stocks dip on inflation fears

- Pennies and the copper industry

- 20 years of Social Security bumps

📰 A great read 📰

Finally, here's a popular story from 2024 that you may have missed. Read it! Share it!

As you ransacked your basement in search of holiday decorations, perhaps you came upon boxes of documents from the last millennium. And then you probably asked yourself: “Couldn’t I just throw these out?”

Common wisdom suggests we keep important papers for seven years, for reasons that, we vaguely recall, have something to do with taxes. For those of us with paper records dating to the Clinton administration, that would seem to mean you can throw them away.

But does that mean everything?

About The Daily Money

Each weekday, The Daily Money delivers the best consumer and financial news from USA TODAY, breaking down complex events, providing the TLDR version, and explaining how everything from Fed rate changes to bankruptcies impacts you.

Daniel de Visé covers personal finance for USA Today.