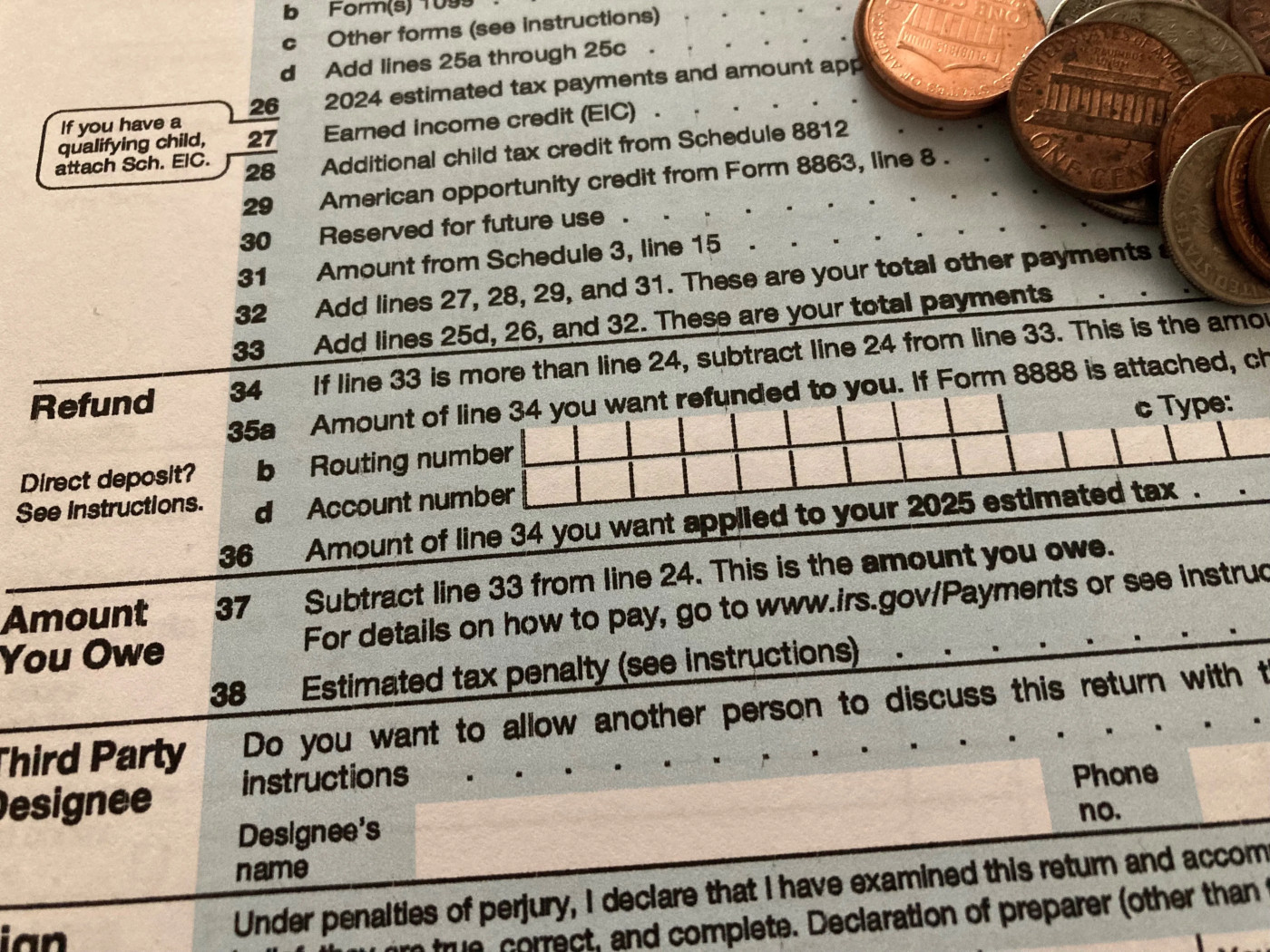

Could IRS layoffs affect your 2025 tax refund? How to check refund status, schedule

As President Donald Trump’s administration continues to make aggressive cuts across the federal government, one agency being hit hard is the Internal Revenue Service.

More than 6,000 IRS employees are set to be laid off with the tax-filing deadline just around the corner, according to reporting from Reuters and the New York Times.

The IRS is just the latest federal agency to see deep cuts. Others include the National Park Service, United States Agency for International Development (USAID) the Consumer Financial Protection Bureau, the Department of Health and the Human Services, and the Department of Education.

Tax accountants have always recommended filing early during tax season, but this year the tip might be more important than ever.

With the IRS down thousands of employees, here's what to know about the 2025 tax filing season, including when to file, how to check the status of your refund and more.

Need a break? Play the USA TODAY Daily Crossword Puzzle.

How could IRS cuts affect the 2025 tax season?

An IRS labor shortage in the middle of tax season could be devastating for taxpayers who want fast refund checks or need assistance, some accountants said. The IRS already is understaffed and has difficulty hiring and retaining employees, according to the National Taxpayer Advocate, an independent organization within the IRS.

Mass firings “definitely will impact tax season as cuts would have immediate impact,” Richard Pon, a certified public accountant in San Francisco, told USA TODAY on Wednesday.

A worker shortage, he said, may mean:

- Processing centers will be understaffed. This especially affects the processing of paper returns, which normally take six to eight weeks. “You can see this double, triple or quadruple,” he warned. Processing paper refund checks will also take longer than the normal three to four weeks, he said.

- Customer service lines will have longer wait times. With layoffs, expect that to get worse, Pon said.

- The few in-person service centers may close. “Normally they also have a Saturday service center open in March or early April, but that will probably be eliminated,” Pon said.

- Processing of correspondence and amended returns, which already takes four to six months, may double as these teams may have to shift to other duties. The IRS has said they will “reallocate workers from other areas to help cover filing season processing” to meet the needs of this filing season.

- Less work for military personnel and their spouses, according to former IRS Commissioner Charles Rettig in a LinkedIn post. Almost 10% of current IRS employees, including “on probation” new hires, are military veterans, he said. Many IRS employees hired to work during filing season also are spouses of current military personnel.

When is the 2025 tax deadline?

This year's deadline will fall on the traditional date of April 15.

Tax Day always falls on that date, unless April 15 is a weekend or holiday. This year, it comes on a Tuesday.

What is the deadline to file an extension?

The deadline to file for an extension is April 15, according to the IRS. That gives taxpayers until Oct. 15 to file without penalties.

For people affected by natural disasters, the extension is automatically given.

Extension requests can be done through the IRS at no charge – both electronically and with a paper form 4868 – and require taxpayers to simply provide basic information like their names, home addresses, Social Security numbers and payment, if they owe anything. But because the extension only applies to filing a tax return, taxpayers must still pay any taxes owed by the April 15 deadline.

What happens if I miss the tax deadline?

For people who forget or miss the deadline altogether, the standard penalty is 5% of the tax due for every month the return is late, up to 25% of the unpaid balance.

A smaller penalty of 0.5% is added if you file a return but fail to pay any taxes you owe, or if you get an extension on your return but fail to pay your owed taxes.

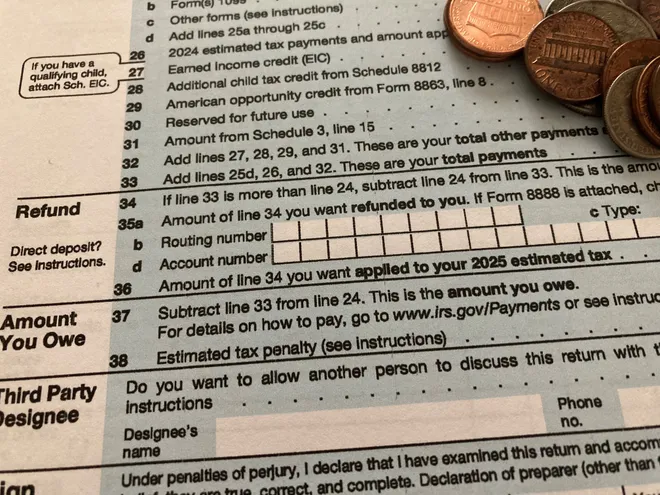

How to check the status of your tax refund?

The "Where is my refund?" tool is an IRS tracking system for filers to get updates on the status of their tax refund. Those looking to keep an eye on their money can log in online or via the IRS2Go mobile app and check back daily to see when they can expect their funds.

Once you log in to the tool and your information starts updating, it will do so once a day overnight. You will then see one of three potential statutes for your refund:

- Return Received – The IRS received your return and is processing it.

- Refund Approved – The IRS approved your refund and is preparing to issue it by a date that will be displayed on-screen.

- Refund Sent – The IRS sent the refund to your bank or to you in the mail. It may take 5 days for it to show in your bank account or several weeks for your check to arrive in the mail.

Contributing: James Powel, Emily DeLetter, Eric Lagatta, Mary Walrath-Holdridge

Fernando Cervantes Jr. is a trending news reporter for USA TODAY. Reach him at [email protected] and follow him on X @fern_cerv_.

Medora Lee is a money, markets, and personal finance reporter at USA TODAY. You can reach her at [email protected] and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday morning.