If you put $1,000 in your 401(k) every month for 15 years, you could have this much by retirement

Most rich investors don't get rich overnight. They do it over a long period of time, making a point of saving for retirement for years on end even when it wasn't easy to do so. Slow and steady wins the race.

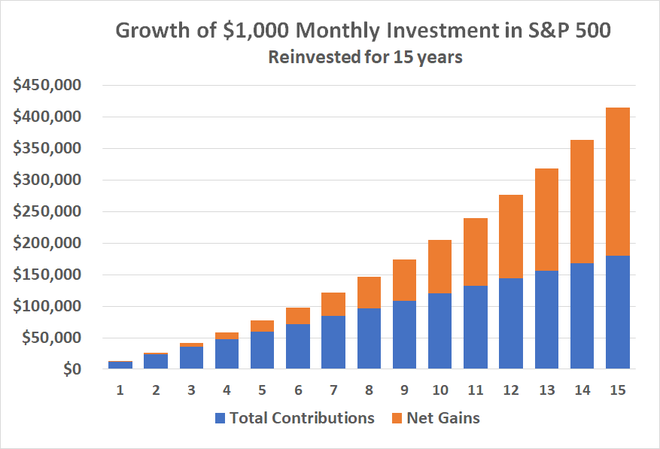

To this end, what could committing $1,000 per month mean over the course of, say, 15 years? More than you might think. Assuming you achieve the stock market's average annual return of 10% on this money, your $180,000 worth of contributions to a 401(k) plan would be worth roughly $414,000 at the end of the time frame.

There are some important footnotes to add here. Chief among them is that while the growth of this hypothetical retirement account is steady from one year to the next, the market is far more volatile. Some years you may even lose ground!

Also notice that most of this account's net growth takes shape during the last one-third of the 15-year span, when the net annual returns on reinvested growth finally eclipse the total contributions of new money. Time really is an investor's best ally!

You should also know that while it's not included in the mathematical projection above, most employers offering 401(k) plans also make additional contributions of their own money to workers' retirement accounts. This of course raises the net monthly contribution, sometimes by quite a bit. This is why you may want to prioritize saving in your 401(k) rather than in a self-funded IRA outside of your workplace even if you don't love all of your investment options within that plan.

Just start somewhere, and sooner rather than later

Certainly, there's no denying an extra $1,000 per month isn't exactly an easy amount of money for most people to come up these days. It may take some sacrifice. Some won't be able to do it.

Even so, starting with a smaller amount is better than not starting at all.

The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

The $22,924 Social Security bonus most retirees completely overlook

Offer from the Motley Fool: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Simply click here to discover how to learn more about these strategies.

View the "Social Security secrets" »