Inflation is cooling, but shoppers remain frustrated by high prices

On paper, the U.S. economy has been strong. Inflation is down from its 2022 peak, the labor market remains solid and robust consumer spending is fueling GDP growth.

But all those metrics mean little to consumers who are struggling to come to terms with the post-pandemic normal, where grocery prices are up more than 25% from 2019.

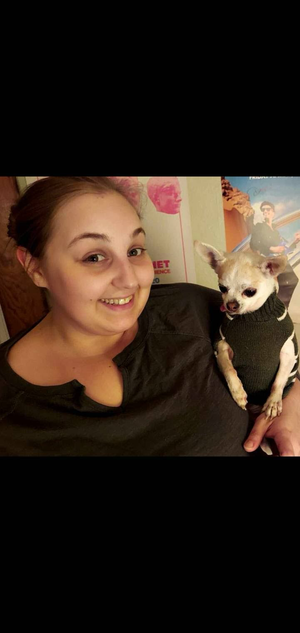

“It seems like (prices have) come to a standstill, but they've come to a standstill at a height,” said Hannah Zak, 33 of Warsaw, New York.

Zak said her $48,000 salary comes out closer to $33,000 after taxes, insurance and retirement savings deposits, leaving her with little spending money. She’s canceled streaming subscriptions, switched to generic brands and cut back spending on haircare products and clothes.

Still, she feels the pinch from inflation each time she forks up around $75 to feed herself and her 7-year-old chihuahua, Princess, for the week. If she's helping her siblings buy groceries, the grocery bill climbs above $100.

Capitalize on high interest rates: Best current CD rates

“Like everybody else, I’ve got a mortgage or rent, a car payment, some debt," she said. “I have a job that's paying me well enough to get by, but there's no extras."

Consumers have noticed inflation slowing but remain frustrated with persistent high prices, according to Joanne Hsu, director of the University of Michigan’s Surveys of Consumers.

“It’s frustrating to see such a high proportion of your paycheck going to your expenses and your bills," Hsu said. “For many of them, as a result, they don’t feel like they’re thriving in spite of the fact that they are perfectly aware that inflation has slowed."

Grocery prices:Even as inflation cools, Americans report sticker shock at grocery store register

How do consumers feel about inflation?

Price hikes have been on a downward trend since June of 2022, when inflation hit a peak of 9.1% year-over-year. The latest Consumer Price Index showed 2.6% year-over-year inflation in October.

That has consumers feeling better about the economy than in 2022, but sentiment is still low by historic standards, according to the University of Michigan’s Surveys of Consumers.

Part of that is because higher prices are here to stay. While inflation has cooled, that doesn't mean prices are falling. Rather, the pace of price increases is slowing. While consumers may be hoping for 2019 prices to return, a widespread drop in prices ‒ also known as "deflation" ‒ is usually a sign of a weak economy.

"We’re not seeing deflation, and we're generally not going to see deflation ‒ that is, a reduction in the price level ‒ unless we’re in some sort of crazy recession," Hsu said. "But I think it is perfectly understandable for consumers to be very frustrated by high prices, even if their wages are going up."

Average hourly earnings growth in the U.S. has outpaced inflation since May 2023, according to data from the Bureau of Labor Statistics. But not every American has seen their paycheck keep up with costs of living. And even those who did get a pay bump are still finding it hard to come to terms with higher prices.

“People would like all wage increases to go to things that are fun,” said Michael Swanson, chief agricultural economist within Wells Fargo's Agri-Food Institute. “They’re happy with the fact that they’ve seen a great increase in their wages, but they’re upset that it has to go to pay for inflation.”

Adjusting to higher prices

Lauren Throop remembers filling up her grocery cart for $75 before the onset of the COVID-19 pandemic. Now, she’s spending closer to $120 to feed herself, her husband and two kids.

“It does feel like things skyrocketed around COVID, with all the talk of supply chain interruptions, and then they just kind of stayed high,” she said. “It feels like grocery prices are still high relative to where they should be."

Throop is part of a growing share of Americans who have grown skeptical of the grocery industry after pandemic-era price hikes. Opinions on the root of food inflation are mixed, but some politicians, including President Joe Biden, have accused food and beverage companies of price gouging.

Throop’s shopping options are limited in Laramie, Wyoming, especially when searching for deals. She said she's not a fan of Walmart, but she’s been shopping there more to cut down her grocery bill.

“It’s been nice to see reports about inflation coming down,” Throop said. But for now, “I’m just trying to cook things that aren’t quite as expensive. I like to cook salmon because it's really good for growing kids’ brains, but I don’t do it as much as I used to. I try to cook things like grains and beans with somewhat more regularity because it’s cheaper.”

Expectations for 2025 and beyond

While inflation has been gradually slowing, some economists worry that President-elect Donald Trump's policies on tax cuts, tariffs and deportations could reverse that trend.

Even if inflation continues to cool, it could take years for prices to feel normal again, according to Swanson of Wells Fargo, especially for regular purchases like those made in the grocery store.

Consumer sentiment could benefit from allowing wages more time to outrun inflation, making everyday purchases feel like less of a blow to household budgets. Consumers also need more time to grow used to prices after dramatic price hikes, Swanson said.

“Say you have a couple kids at home and milk is a big part of what you buy. You know when that changes,” he said. “It takes years to reset that. ... It could be a couple years before people are thinking, ‘Yeah, this is fair.’”