The Daily Money: No more medical debt on credit reports?

Good morning! It’s Daniel de Visé with your Daily Money.

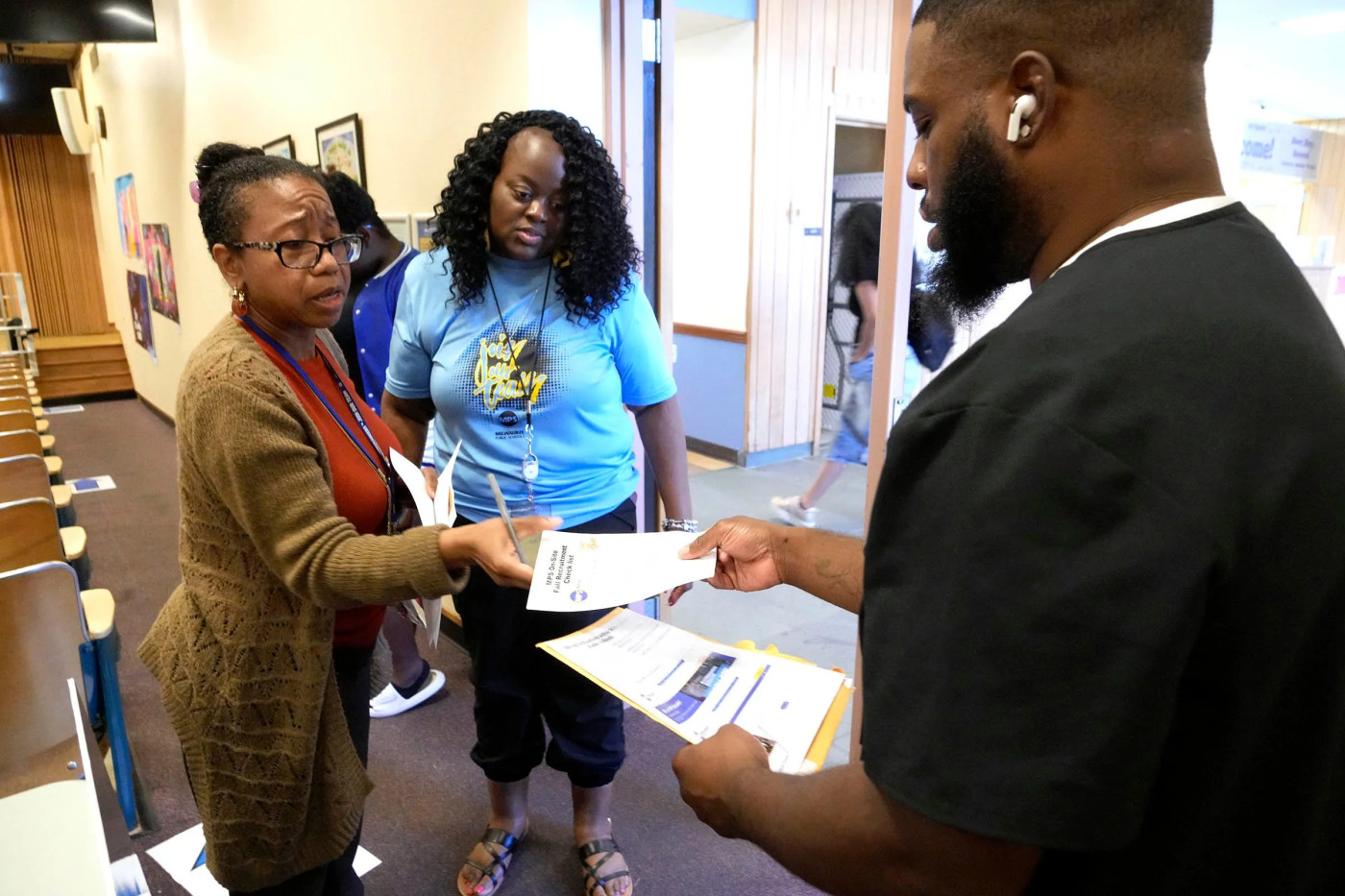

The Biden Administration announced an initiative Tuesday to remove an estimated $49 billion in medical debt from the credit reports of roughly 15 million Americans.

A new rule from the Consumer Financial Protection Bureau would ban the inclusion of medical bills on credit reports and would bar lenders from using medical information when they make lending decisions.

Here's what it means for consumers.

Why conservatives love crypto

Ask yourself which Americans are most enamored of crypto, and a few descriptors may come to mind: Millennials. Techies. Guys.

Republicans? Maybe not.

But new research from the University of Pennsylvania finds that Republicans are more likely than Democrats to invest in cryptocurrency and that some regions are more inclined than others to hop on the bandwagon. Texans, for example, are fonder of bitcoin than Oregonians.

The study may help explain why President-elect Donald Trump has loudly signaled his support for crypto.

📰 More stories you shouldn't miss 📰

- Sports streaming shakeup

- How to manage negative feedback

- Top Fed 'banking cop' steps down

- Enron unveils home nuclear reactor

- How likely is a strategic bitcoin reserve?

🍔 Today's Menu 🍔

McDonald’s is the latest major company to flip its diversity, equity and inclusion policies, Jessica Guynn reports, amid a growing beef between those who support the efforts and political conservatives alongside the incoming Trump administration.

Citing the Supreme Court’s 2023 decision banning affirmative action in college admissions and the “evolving landscape around DEI,” the fast-food giant said Monday it would no longer set goals to increase diversity in senior leadership.

For more on the corporate DEI struggle, read the story.

About The Daily Money

Each weekday, The Daily Money delivers the best consumer and financial news from USA TODAY, breaking down complex events, providing the TLDR version, and explaining how everything from Fed rate changes to bankruptcies impacts you.

Daniel de Visé covers personal finance for USA Today.