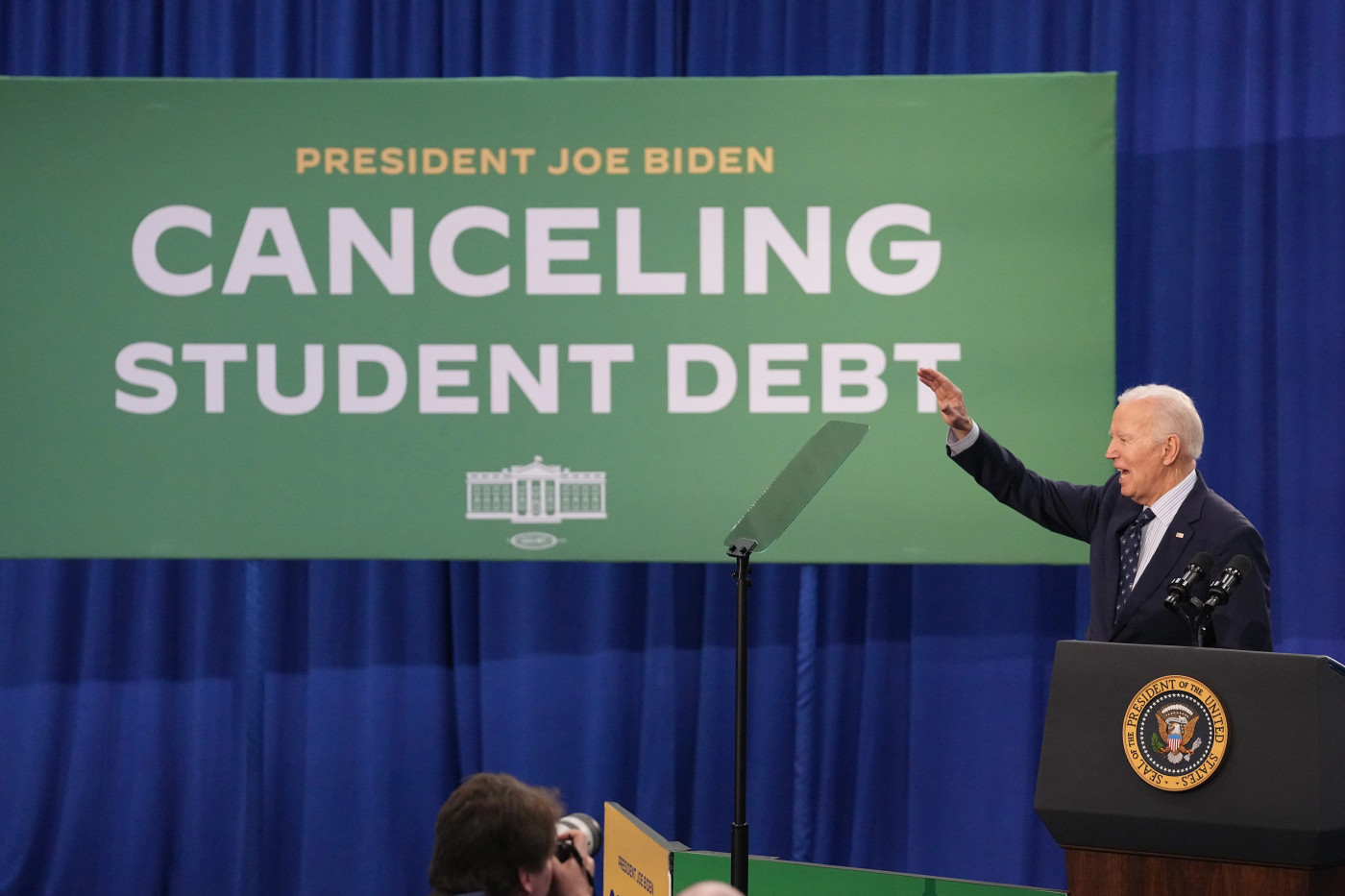

In last major batch of student loan relief, Biden forgives $4.5B for 261K borrowers

WASHINGTON – The Biden administration approved its last major batch of student loan relief Wednesday, greenlighting $4.5 billion in forgiveness for 261,000 borrowers.

The recipients of the debt cancellation attended Ashford University, a former for-profit school that the U.S. Department of Education determined made “substantial misrepresentations” about its program quality and costs to federal student loan borrowers. The school was later acquired by the University of Arizona, which enlisted Ashford’s parent company, Zovio, to run its University of Arizona Global Campus.

The federal agency greenlit the relief through legal grounds called borrower defense to repayment, a program that allows the federal government to grant discharges for defrauded students. Borrowers approved through the program usually have taken out loans to attend schools subsequently found to have engaged in misconduct, such as exaggerating how much money students can expect to make after graduation.

James Kvaal, the education under secretary, said in a statement Wednesday that state and local investigations have shown that 90% of Ashford students never graduated. Those who did were left with hefty debt and only able to earn low wages, he said.

“Today’s announcement will finally provide relief to students who were harmed by Ashford’s misdeeds,” Kvaal said.

The new batch of debt cancellation comes a few days after the administration said it passed the milestone of forgiving nearly $200 billion in student loan debt for more than five million borrowers during Joe Biden's presidency. Biden initially hoped to waive student loan debt for tens of millions of Americans, however, his administration didn't come close to that goal, due in part to congressional opposition and court challenges.

The Education Department on Wednesday also proposed banning Andrew Clark, the founder of Zovio, from leading any institution that receives federal financial aid funds. Clark departed the company in 2021. At the time, Zovio's board chair said he led a "historic sale" and that he "laid the foundation for Zovio to provide excellent service to our partners and extend our ability to innovate and expand our ed tech services and solutions."

As President-elect Donald Trump prepares to take office, advocates for borrowers are concerned whether borrower defense will revert to the less aggressive version of the program that existed during Trump's term as the 45th president, which approved far fewer applications. There are still a few hundred thousand borrowers waiting on answers in their borrower defense discharge cases, according to department officials.

The Supreme Court, meanwhile, decided late last week to review the Biden administration’s appeal of a lower court decision blocking a regulation that would have made it easier to approve borrower defense discharges. That rule has been barred since 2023.

It’s one of many Biden-era college affordability policies stalled in court. In a farewell speech at the Education Department in Washington, D.C., Tuesday, outgoing Education Secretary Miguel Cardona said that although he’s unsure what regulations will survive the next administration, he remains optimistic about the future for American students.

“We can’t spend too much time wallowing in uncertainty,” he said. “The truth is I’m leaving here with a great deal of hope.”

Zachary Schermele is an education reporter for USA TODAY. You can reach him by email at [email protected]. Follow him on X at @ZachSchermele.